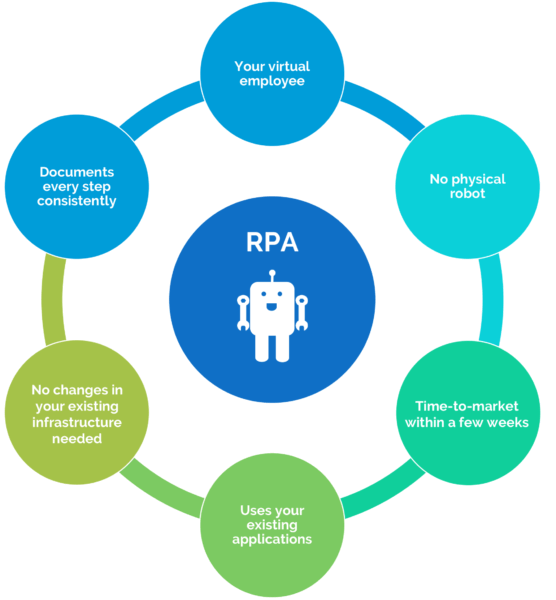

RPA (Robotic process automation) is the software interaction relocating the work of humans. In other words we can say Robotic process automation automates the process that used to be done by human labour. Therefore the purpose of RPA is shifting of human labour to bots using the software applications that automates the process and reduces the precious time of the input of any business or company. It synchronizes with the existing infrastructure and with minimal or no complication required for shifting from manual system to full automation.

RPA development company DICEUS works tediously for automation services like RPA. They have gained a lot of respect in terms of their services around the world

How RPA is helpful for business

Call centre calling and operations-

There are a number of customers who call the call centre of the businesses or companies for help and Robotic process automation helps in disposal of their problems. This is done via an automated process navigating a customer via automated calling process and software support to the desired category of query. In this way a customer representative can dispose of the query successfully raised by any customer when he calls for help. Therefore in this way the business can grow itself with better customer service and disposal of their grievances.

Processing of forms and migration of data

In order to migrate the precious data from an obsolete system to the contemporary one we take the help of RPA. Before the evolution of this revolutionary technology, this migration used to take a lot of time to get completed. With the help of Robotic process automation we can complete this process with the minimal error. Additionally with the help of RPA data upon the paper can be transformed into digital form and it exponentially helps in transformation of any company from paper to paperless system.

Fast claims disposal in insurance sector

When we talk about use of RpA in the insurance sector, then we cannot deny its contribution towards the disposal of claim cases and expedited claim processing. RPA tools are used to do this whole processing from claiming to dispose of a policy in a very swift manner and it is done without any error. The application also takes unnecessary steps and rejects the claims that don’t comply with the terms and conditions of the insurance in a rapid manner. Thus RPA helps in growth of the insurance sector in terms of service and time taken for processing the claim of the policy. And it ultimately increased the insurance market share in the overall service sector and pulled a lot of customers altogether with better software support.

Improved help desk

Robotic process automation has a major contribution in smooth help desk experience by a user. With the help of RPA the repetitive queries of the user are fixed with a very convenient process. It reduces the user time by prioritizing the repetitive queries according to the user query raised at that point of time. This helps the user get the solution from the help desk in a convenient way without going through a long and tedious way.

Effective schedule management

In managing the hospital appointment and scheduling of patients – doctors appointments are best managed by robotic process automation. With the introduction of RPA technology the whole management and schedule of the hospitals have improved marginally. Bots that are part of RPA gather all the information about patients such as last appointment, insurance details, request for appointments, location preferences, etc. This collection of vital data makes the whole schedule management hassle free and proved to be highly effective.

Credit card solutions

Robotic process application has efficiently turned the financial sector, when we talk about use of RPA in credit card processing. With the hlop of bots from basic to major operations are automated in terms of credit card operations. With the inclusion of RPA it can successfully achieve the overall high level of satisfaction for the collection of data of clients to store the documents of the consumers. In other words it performs all the necessary operations from documenting the consumers data to performing a background check. Thus doing those process bots decide whether the client or consumer is eligible to get a certain amount in the form of credit in his card.