rajkotupdates.news : us inflation jumped 7.5 in in 40 years : the United States has experienced a significant surge in inflation, raising concerns among policymakers, economists, and everyday consumers. Inflation is a crucial economic indicator that measures the general increase in prices of goods and services over time. To comprehend the implications of this surge in inflation, it is essential to explore its underlying causes and potential impacts on the economy and people’s lives.

Also read : https://spikysnail.com/2023/08/04/vofey-shop-the-ultimate-online-fashion-hub-for-women/

What is Inflation?

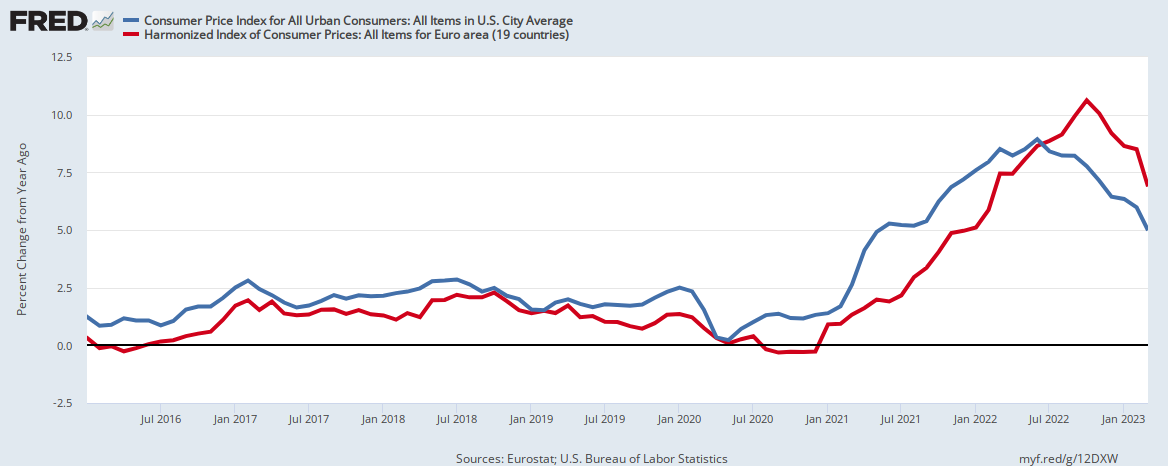

Inflation refers to the sustained rise in the overall price level of goods and services in an economy. It is often measured using the Consumer Price Index (CPI), which tracks the average change in prices paid by consumers for a basket of goods and services. Inflation can erode the purchasing power of money, affecting the cost of living and the standard of living for individuals and families.

Historical Perspective on U.S. Inflation

To understand the current inflation surge, we must first examine historical trends. Over the past 40 years, the U.S. has witnessed periods of both high and low inflation rates. Various factors, such as economic growth, energy prices, and government policies, have influenced inflation in the past.

Recent Surge in U.S. Inflation

In recent times, the U.S. economy has experienced a startling increase in inflation rates. Reports show that inflation jumped by 7.5% in the past 40 years, marking a significant departure from the relatively stable inflation rates of the previous decade.

Causes of the Inflation Surge

Several factors have contributed to the current inflationary pressures. One major factor is the disruption in global supply chains due to the COVID-19 pandemic. us inflation jumped 7 5 in in 40 years rajkotupdates news :The shortage of raw materials and delayed shipments have led to price hikes for various goods. Additionally, the increased consumer demand following the reopening of the economy has further driven up prices.

Furthermore, the monetary policies adopted by the Federal Reserve, such as the lowering of interest rates and quantitative easing, have injected a substantial amount of money into the economy, potentially fueling inflation. Fiscal measures, such as stimulus packages, have also contributed to the surge in consumer spending, adding to inflationary pressures.

Housing Market and Inflation

The booming housing market has been a significant contributor to inflation. The surge in home prices and rental costs has pushed up the shelter component of the CPI, impacting overall inflation rates.

Impact on Consumers

The recent surge in inflation has had a profound impact on consumers. As prices rise, the purchasing power of money decreases, making it more expensive for consumers to buy essential goods and services. This can lead to a decrease in the standard of living for many households.

To cope with inflation, consumers may have to cut back on discretionary spending or seek cheaper alternatives for goods and services. This shift in consumer behavior can have implications for businesses and the overall economy.

Effects on Investments and Savings

Inflation also affects investments and savings. As inflation rises, the real value of investments may decline, especially those with fixed returns, such as bonds. Investors may seek inflation-hedging assets, such as real estate or commodities, to protect their wealth.

Savers may face challenges as well, as the interest rates offered by banks may not keep up with inflation, leading to diminished returns on savings accounts.

Government Response to Inflation

The Federal Reserve plays a crucial role in controlling inflation. It may implement monetary policies, such as adjusting interest rates, to influence borrowing and spending behavior. Additionally, governments can employ fiscal measures to manage inflationary pressures, such as reducing spending or implementing tax policies.

Global Factors Affecting U.S. Inflation

U.S. inflation is also influenced by global factors. International events, such as geopolitical tensions or changes in commodity prices, can impact inflation rates. us inflation jumped 7 5 in in 40 years rajkotupdates news :Supply chain challenges in other parts of the world may also affect the availability and prices of goods in the U.S.

Inflation vs. Wage Growth

One significant concern during inflationary periods is the disparity between inflation rates and wage growth. When inflation outpaces wage increases, the purchasing power of workers diminishes, leading to financial strain for many households.

Future Outlook on Inflation

The future trajectory of inflation is uncertain and depends on various factors, including the effectiveness of government policies and the containment of global supply chain disruptions. Experts predict that inflation may persist for some time before stabilizing.

Conclusion

rajkotupdates news :he recent surge in U.S. inflation has raised important questions about its causes and implications. Supply chain disruptions, increased consumer demand, and government policies have all played significant roles in driving inflation upward. As prices rise, consumers and investors alike are facing challenges in maintaining their purchasing power and protecting their assets.

As the economy continues to evolve, it is crucial for individuals, businesses, and policymakers to monitor economic indicators closely. Understanding the dynamics of inflation can empower us to make informed decisions and navigate the complexities of the ever-changing economic landscape.

FAQs (Frequently Asked Questions)

1. How can inflation affect my everyday life? I

nflation can impact your everyday life by increasing the cost of goods and services, leading to higher expenses for necessities like groceries, housing, and transportation.

2. Are there any benefits to moderate inflation?

Moderate inflation can be beneficial as it encourages consumer spending and investment, fostering economic growth. It also allows for the adjustment of wages and prices over time.

3. How can I protect my investments during inflationary periods?

Investing in assets like real estate, commodities, and inflation-protected securities can help protect your investments from the eroding effects of inflation.

4. Will inflation eventually subside on its own?

The duration and intensity of inflation depend on various factors. It may subside over time as supply chain disruptions are resolved and the economy stabilizes.

5. What can the government do to combat inflation?

Governments can implement monetary policies, such as adjusting interest rates, and fiscal measures, such as controlling spending, to manage inflationary pressures.